Bruges Group Blog

Much ink has been spilt in recently over what would have happened to the economy if Britain had voted to remain. For all the publicity this has generated, this question is purely academic. As fans of 90's films Sliding Doors and The Butterfly effect can attest, when you make even one tiny change to your starting conditions, what comes next is total...

Socialism is incompatible with democracy. It is by nature totalitarian and can brook no opposition to its goals. Lenin knew that and was quick to stamp on Russia's nascent democracy. Russia became a Republic on the 1st of September 1917 with the establishment of a Provisional Council as a temporary parliament. Preparations for elections to a Consti...

It was, from what I gather, George Bernard Shaw who made the famous quote that "Youth was wasted on the young". Now I am in the later years of my life and look back I can see how I wasted my youth, although I must admit to having a good time spending my earnings on booze and sports cars. It was not until I was married and into my thirties, when wor...

Wednesday, 16th July 2025 6.30pm until Late The Speakers; Andrew Griffith MPShadow Secretary of State for Business and TradeRichard Tice MPDeputy Leader of Reform UKRoger BootleChairman of Capital Economics&Professor Tim Congdon CBELeading economic commentator will discuss immigration and Britain's position in the world Speakers wi...

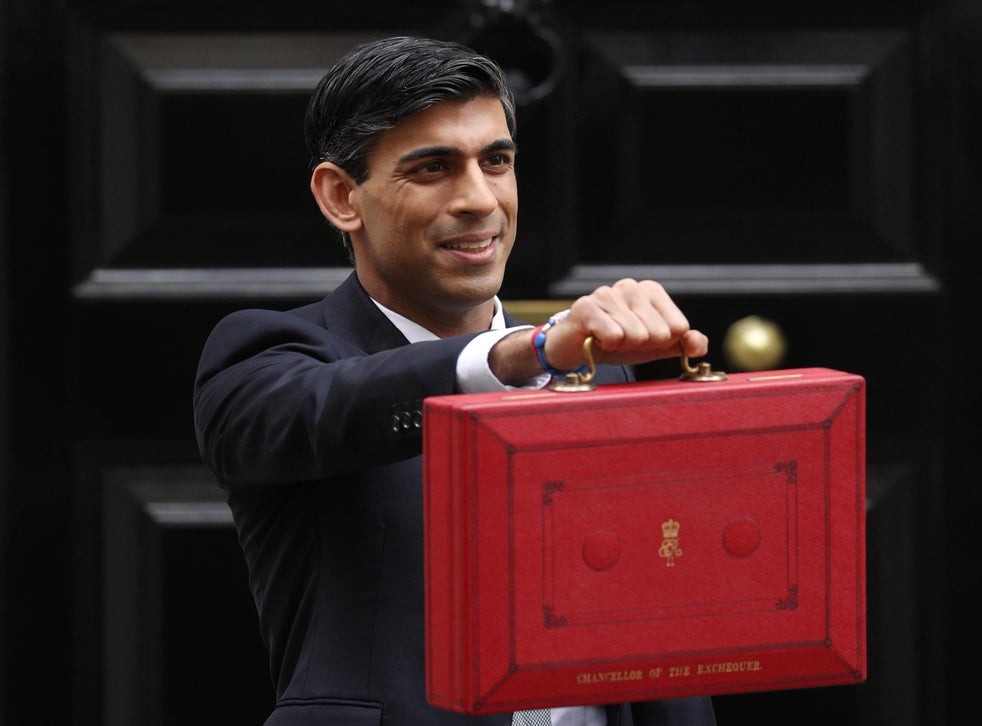

Many of the comments on last week's Budget have pointed out that taxes, already very high, are being pushed higher, and that government borrowing, also very high, is being pushed higher still. Some commentators are asking – not for the first time – whether the British economy can absorb this amount of taxation and government borrowing, or whe...

Reason For The Study So, the disgraceful anti-British government of Kier 'two-tier'/ 'free-gear'/ 'flip-flop'/ 'sausage' appears to have declared war on the farming community. For those of us outside the London 'bubble' who follow politics, this has come as no surprise: after all, most farmers are rural (not urban) in outlook, based in rural ...

Mr. Speaker, it is an honour and a privilege for me to have this opportunity to present to the House the government's budget for the coming year. As the House will already know, our economy and government finances are in a desperate and sorry state. Over the past nearly 25 years we have suffered a series of setbacks that have enveloped us in a perf...

The Labour Party has its Oxbridge officer class but the other ranks have to be kept in check or they - its power base - may wander off. As with the cynical saying about drug companies ('a patient cured is a customer lost'), a voter who aspires to the middle class is a mutineer to socialism. The ladder is, or was, education. So in 1965 grammar schoo...

A lasting regret of my time travelling in the ex Soviet Union is not having bought a postcard. In my mind I can still see the object of my regret. It was titled 'Sofia by Night'. The photo was of the main square in Sofia, Bulgaria. Brightly lit at night. No traffic, no people, not a dog, cat or owl, just an empty square. I never enjoyed my business...

When I wrote the article: 'How to destroy a country' for this esteemed blog, I meant it to be seen as a warning. Sadly, from their actions, it appears our Labour Government have used it as an instruction manual, they have taken the art of wrecking this nation to frightening new heights. During the run up to the July 4th general election Sir K...

The typical employee's wage slip is something of a con. Here's how it works. For earnings between £12,570 and £50,270 p.a. there are deductions of income tax at 20%, employee NIC at 12% but an additional 13.8% NIC is paid by the employer. If someone on the average salary of c. £33,000 a year gets a raise of £1,000 the worker pays £320 in tax/NIC an...

There are three certainties that come with every Labour Government, these are: Labour always raise and find new ways to tax the population, they are hypocrites and every Labour Government has left office leaving the country in one hell of a mess. Sadly, nothing will deviate from this statement regarding our newly elected Socialist masters. As...

Britain's political scene is sporadic, but one constant stayed through it all: skyrocketing national debt poor judgment in allocating public spending. Since 1988, national debt has gotten out of control, and now sits beyond GDP. Parliament's economic judgment have faltered post-Thatcherism, with successive prime ministers failing to replicat...

Some years ago, at a Cambridge University event, I talked to a young lady PhD student. She explained that she was hoping for a career in HMRC or the Treasury. To boost her opportunity she was preparing her thesis on the subject 'Flat tax inefficiency and economic damage'. It was a social event and I did not engage her starry eyed subservience to or...

As we move ever closer to the 4th of July, we deserve to hear the plans of those parties most likely to form the next government – the detail, and how any 'wish-list' would be costed. Until detail is supplied, then any manifesto promise, or gimmicky card 'pledge' is meaningless, as there is nothing specific against which to hold a newly-elected gov...

Multiple credit cards and a carefree attitude to paying-off bills was at one time the preserve of the more feckless section of society. These days it seems to be a universal ill of local finances and it is a trend that central government has fostered. As local authorities teeter on the brink of insolvency – indeed by any 'normal' accounting assessm...

'Big crash coming' says Jimmy Dore, introducing his guest Paul Stone. https://www.youtube.com/watch?v=1zBEofwgshI&t=20s They agree that the economy is being mismanaged, because interest rates are too high and the debt is ballooning. The problem is that everything depends on facts and interpretation, and about the only fact that is unchallengeab...

We have a two-tier pension system in the UK whereby MPs and public sector employees have a defined benefit or final salary pension, whereas private sector employees have a defined contribution or money purchase pension. This raises the question: should the pension arrangements of MPs be aligned with those of employees in the private or public secto...

Straws in the wind The NHS The NHS is crumbling and cannot continue for much longer in its current form. Free healthcare for all at the point of need was possible in the late 1940s and early 1950s but with ever more costly and complex interventions this is no longer the case. None of the modern imaging equipment had been invented when t...

Why have the Conservatives increased the burden of taxation on individuals earning between £100,000-£150,000, whilst at the same time reducing the burden on those earning over £150,000? Is this, yet another example, of how Conservatives have become out of touch with their key supporters?Under the last Labour Government taxable income between £100,0...

Reform or Revolution? This is the question. One way or another there will be no more "status quo" on our current course because: if Labour wins, we will have socialism; if things do not change, history shows there will be violence (a revolution). The parallels between the present and the French Revolution (as well as the fall of Rome) are self-evid...

Women seem to provide us with consistently better common sense leadership than men. Leadership that reflects the values of the majority rather than a self-indulgent minority. Elizabeth 1, Queen Anne, Victoria, Margaret Thatcher all reflected the hopes and wishes of the people. All were proud of their country and their pride was matched by the ...

The tax on alcohol has been raised by 10.1%; the reasons given are 'wider UK tax and public health objectives.' It's mostly to do with the money: last year the Treasury raised £12.4 billion from alcohol duties. This compares with around £8 billion in the US, which has 5 times our population. Clearly the UK Government needs the cash and depends on d...

The general public has little idea of how much debt hangs over our heads. Today, Laura Perrins warns us that government borrowing is now equivalent to 99.2% of GDP (i.e. a whole year's worth of national economic activity); but that is only the tip of the iceberg, because it is only looking at public sector borrowing. Unlike the UK, where valuable f...

John Redwood's Lecture, All Souls College, Oxford Rt Hon Sir John Redwood will be giving a lecture on the great western inflation of the last two years. He will examine the role of the Central banks, explain how they could have avoided the general price rises, and ask how the Bank of Japan, the Swiss Central Bank and the People's Bank of Chin...

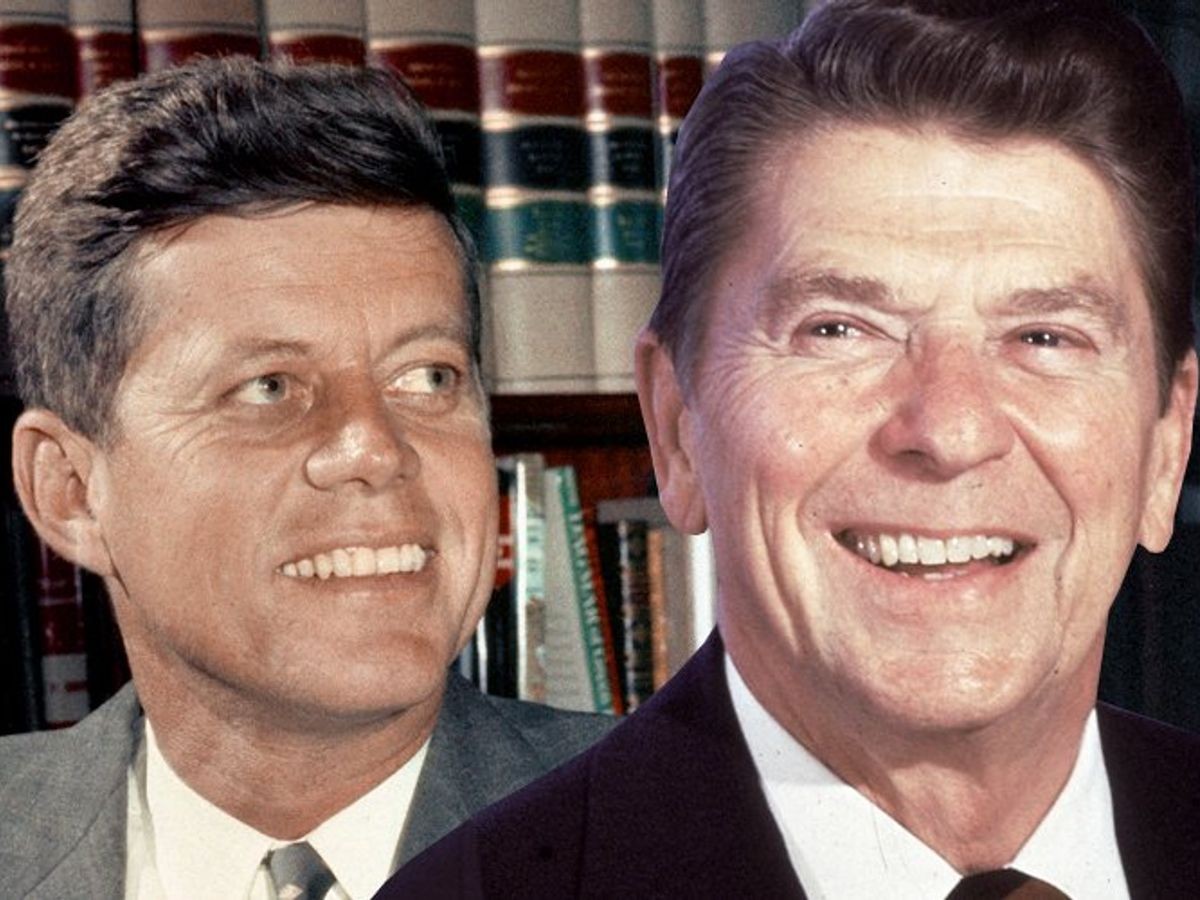

Politicians should have a vision. George H. W. Bush's perceived lack of one probably cost him a second term. Atlee's vision of a British Socialist Commonwealth condemned the UK to a painful exodus from the privation of WW2. Its legacy hampered our development. The Reagan - Thatcher vision was a time of hope, a vision of a renewal for the world demo...

With little discussion most of the world (the democratic west at least) is in a race to a net zero bottom. Scientific evidence is manipulated to 'prove' carbon damage. Normal climate variations that have existed since the world began are now labelled a 'Climate emergency'. Scientists who disagree are silenced by withdrawal of funding and or loss of...

The Bruges Group is pleased to republish this article by Barnabas Reynolds Brussels' rules are prescriptive and controlling, and are holding back British growth The Prime Minister must restore Britain's sovereignty over our laws The Government is seeking the power to remove some of the vast swathes of EU-inherited law by the end of 2023 in it...

For over a century the UK has struggled with political realism and to an extent, its identity. In 1918 the Labour Parties pamphlet 'Labour and the New Social Order' set out an essentially communist agenda. Beatrice and Sidney Webb's 1920 book ' Constitution For The Socialist Commonwealth Of Great Britain' fleshed it out. Many were taken in by talk ...

A competent Conservative Government would have rectified the anomaly of taxable income between £100,000 and £125,140 being subject to an effective tax rate of 60%. It is clearly anomalous for the effective tax rate to rise from 40% to 60% on income in this band and then fall to 40% on income between £125,141 and £150,000 before rising to 45% on inc...

An energy crisis hit world economies and after almost three years the pain exploded in most countries. The exception was the USA. Acting pro-actively President Reagan slashed regulation to free the economy. He fired over 11,000 striking air traffic controllers. Breaking the strike. An action Paul Volcker saw as a 'watershed' moment in the battle ag...

There is a disconnect between the media, politicians and the people of the UK. We are fed a daily diet of gloom. Hysterical millionaire 'experts' rant with messianic fervour. A plethora of experts, who helped cause the problem, seek to out do each other in their apoplectic zeal to blame others. It is as if they seek to reprise the late Jack Hawkins...

It is time to reset our expectation of democracy. We have drifted into a situation where people vote for politicians who, mostly, ignore their duty. That duty is to protect the nation and its people. To create an environment where, in security, hard work is rewarded and people can flourish peacefully under the law. Perversely, politicians have adap...

Democracy, liberty and the continuation of western civilisation is under threat. It is threatened by those we have elected to protect and nurture our society. A small number of self entitled politicians and bureaucrats take decisions without reference to their electorate. Sunak's decision to raise Corporation tax to 25% next year has everything to ...

Thirty years ago, twenty-three Conservative Members of Parliament voted against the Maastricht Treaty. Our main concern was that it opened the door to the abolition of the Pound and its replacement with what became the euro. Some twenty-seven years later in two-thousand and nineteen, twenty-seven Conservative Members of Parliament voted against The...

By Barnabas Reynolds. The Brexit Freedoms Bill aims to end the special legal status of EU law. It will also simplify the removal of retained EU law. Here Barnabas Reynolds explains the advantages for the City – and the economy. The UK has recently been confronted with a series of adverse economic shocks – from Covid and the war in Ukraine, to the c...

Some people who start a business dream of it becoming an enterprise that is passed down through generations. While this is true for some companies and families, it can also be a fraught ambition. Families can be dysfunctional, and when that dysfunction is transferred to the workplace, it can be catastrophic for the business. Furthermore, there is n...

GET ON YOUR BIKE No matter where we turn, it's the environment. It's the Earth! And like the Earth, my head is spinning from all of the information and the hypocrisy of private jet riding, elitist, globalists Davos attendees. However, I believe the answer is in the spin: spin the pedals. I believe it is time that we got on our bikes - especially th...

This week has been another shocking reminder how far adrift today's Conservative Party are from the principles enunciated and implemented by its greatest peacetime leader Margaret Thatcher. To me personally, this has been dramatically emphasised by the loss of Westminster City Council to the Labour Party. Some thirty years ago as the Finance Chairm...

Margaret Thatcher broke the mould of British politics. A grocer's daughter raised above the family shop. She benefited from free state education including university. She believed in equal opportunity. She believed in wealth distribution through hard work and getting rid of as much state intervention as possible. As Prime Minister she encouraged pr...

Boris Johnson is often dismissed as a know-nothing on economics, and Rishi Sunak prides himself on being rather good at it. In his generally excellent recent Mais lecture, the Chancellor set out his vision for the UK economy. He aims for freeing up markets, improving regulation, and cutting taxes to incentivise investment, training and R...

Outputs from Spring Statement In advance of the promised reveal of the government's energy plan this week, let's start with the positives from Rishi Sunak's Spring Statement. 5 whole years of VAT free purchases on solar panels, ground and air source heat pumps. Not in Northern Ireland of course but they seem to matter less than ever to the Conserva...

United Kingdom rates of personal taxation are at their highest in over 70 years. They are set to increase further. Whether or not governments spend the money they raise wisely? That's another piece for another day but my overarching view is that individuals make better spending choices than "the state". This article examines the ways in which the T...

When Parliament fell to debating various versions of a Withdrawal Agreement between the UK and the EU some of us had no wish to enter binding arrangements with the EU that could continue to prevent us making sovereign decisions for ourselves through elections and Parliamentary votes. I along with 27 other Conservative MPs voted three times against ...

Download PDF File Here Mr Sunak's Spring Statement was far less impressive than his rhetoric has made it appear. Once again a senior member of this administration reaches a Gold Standard in rhetoric, but at best a Bronze one in achievement. The claim does not stand up to examination that these were the largest reductions in personal taxation for th...

The campaign for a referendum on Net Zero appears to be gathering pace, with Nigel Farage openly discussing its evolution on his nightly GB News programme this week. Accepting the premise of global warming and the need to avoid the Earth's temperature overheating has become a settled issue for many but not all. Ground source heat pumps, electric ca...

"Never glad confident morning again" This was the phrase used by Nigel Birch in the Profumo debate of June 1963 to encapsulate the situation in which Prime Minister Harold Macmillan found himself. Four months later, Macmillan decided to resign. I have always been struck by the similarities between Macmillan and Johnson. They both went to Eton and B...

Fourth upon a time the Brexit elf went in search of the true Brexit. He had been over the moon all those years ago when the British people had voted to leave the EU. He looked forward to an early and complete departure. He expected the creation of a land of freedom. He looked forward to wise government from a newly independent and powerful Parliame...

Introduction The purpose of these notes is to present some facts about the campaign to stop global warming and climate change. The climate has changed in the past, is probably changing now, and will change in the future. The campaign is trying to stop the unstoppable. The natural factors affecting global temperature are very powerful: terrestrial, ...

I had the opportunity to speak to Lord (Peter) Lilley, a former speaker at a Bruges Group conference who served in Cabinet in the Thatcher and Major Governments as Secretary of State for Trade and Industry and Secretary of State for Social Security – and later in William (now Lord) Hague's Shadow Cabinet as Shadow Chancellor of the Exchequer and De...

At Conservative Party Conference this year, we are delighted to be hosting the 'Liberty Zone' on Monday 4th October 2021 at the Science and Industry Museum, Liverpool Road, Manchester, M3 4PF. We are holding our annual Party Conference event this year alongside Time 4 Recovery, a group set up to pressure the government with oppositi...

You get to meet some interesting people on holiday, each year for several years my better half and I would return to the same hotel during the same two weeks in June where we would meet up with other regular returning guests. One of them was a senior accountant with a very large firm, he once told me every time they had to produce a cheque to pay t...

Hands up, who still thinks the Conservatives are a low tax party? If your hand is up, might I suggest you put it swiftly down and start writing some letters to the 321 Tory MPs who this week voted in favour of the biggest tax hike since the Second World War. Someone ought to inform them. Someone also might want to disband CCHQ come the next general...

SIR – Extra taxation on savers to fund the NHS and care-home fees is bizarre. Some paying the extra tax may have been motivated to save in order not to depend on the state in their old age. Now achieving that objective will be undermined. Others will be care-home residents, now having to make a higher tax contribution to fellow residents' costs.&nb...

I had the opportunity to speak to the Honorable John Manley, a long serving Cabinet Minister in the Canadian Government, having served in key posts such as Deputy Prime Minister, Minister of Finance, and Minister of Foreign Affairs – among others. John Manley is also known for having authored the Manley Report on Afghanistan in 2007 and having been...

Clearly neither Wales nor Scotland could create their own currencies: they would have to stay with the pound or join the euro. And since the euro is hugely unpopular in Scotland (only 18 per cent of Scots want to join the euro) - and would simply introduce dependence on Brussels - that would mean sticking with the pound. Yet Alex Salmond seems...

The United Nations Intergovernmental Panel on Climate Change (IPCC) published its sixth assessment report in August, setting off a chain reaction of apocalyptic responses. IPCC was set up in 1988 to scientifically understand human-induced climate change, its impact and possible responses. But every IPCC report since the first in 1990 has been accom...

With more scandal and sleaze gushing out of Westminster than the Sussexes press office, one could be pardoned for glossing over the government's latest flirtation with the supercilious head of nanny statism. Last week, the Department of Health confirmed plans are going ahead to restrict paid junk food advertising, in order to curb childhood o...

Today marks 34 years since one of the most memorable and historic speeches ever made by a US President, and one that changed the course of history, it is of course when President Reagan stood in front of the Brandenburg Gate in Berlin and told General Secretary Gorbachev to "tear down this wall". Now as we face today's challenges, our leaders shoul...

A major City group has just published a report calling for an immediate development of an e-pound Britain could create a Western alternative to a Chinese digital/e-currency It is not generally appreciated that over 98% of UK transactional banking (by value) takes place in what is known as 'the wholesale market'. Less than 2% takes place in the reta...

I have become seriously concerned about green issues. No, I have not suddenly become a tree hugging greenie wishing to revert back to the days of horse and carts and candles to light our homes, my concern is with the measures coming our way to enforce a Stasi like, totalitarian green regime upon us. Many people are living in ignorant bliss of...

This new study, issued through The Bruges Group, dissects a main response of the European Central Bank to the pandemic: another programme of bond buying, taking up hundreds of billions of euros of Eurozone member state government bonds into the ECB's Pandemic Emergency Purchase Programme, the "PEPP". The PEPP bought the majority of new debt issued ...

John Longworth was the Director General of the British Chambers of Commerce; he was also an MEP and co-Chairman of Leave Means Leave. A great problem with many politicians and most civil servants is that they don't understand business. The reverse is probably also true. The enterprise economy is alien to the political class and they tend ...

As the Chancellor prepares to deliver his Budget, we want to make clear a few brief advisories to Mr Sunak on what this historical Budget should contain. First of all, there has been plenty of speculation from countless newspapers and TV reports that the Chancellor is plotting tax increases, namely corporation tax and potentially freezing tax bands...

I caught up with former Brexit Party MEP, Ben Habib who now runs the pressure group 'Unlocked', campaigning for an end to lockdown and highlighting the economic and social damage of remaining in lockdown. You can watch the full conversation on YouTube, with links to the videos throughout or digest a condensed summary on each question and debate poi...

By The Rt. Hon. Sammy Wilson MP - DUP Member of Parliament for East Antrim As the U.K. edges toward a final deal on its future relationship with the European Union, it is important that we ensure the agreement delivers on what was promised. Already it is clear that last year's Withdrawal Agreement was fatally flawed. It leaves Bruss...

Starting with the implications of the second lockdown, the former Cabinet Minister said it will be damaging for the economy though not as damaging as last time. The virus should be taken seriously – and treatments should be sought etc. – but let's get life back to normal for those free from the disease or not at much risk, he said. Sir John hopes t...

Initial article on The Bow Group By Robert Oulds and Dr Niall McCrae "You'll own nothing, and you'll be happy" (World Economic Forum, 18 November 2016). Covid-19 is a crisis too good to waste for UN agencies and other transnational bodies. The coronavirus pandemic has led to governments around the world signing up to the 'Great Reset' designe...

Link to the full paper by the Centre for Brexit Studies By The Rt. Hon. Sir Iain Duncan Smith MP (Conservative Party MP), Martin Howe QC (Intellectual Property and EU Law; Chairman of Lawyers for Britain), Professor David Collins (International Economic Law, University of London), Edgar Miller (Managing Director of Palladian Limited;...

As the US general election approaches, it is very much in our interests on who wins, there are some people in the Conservative Party suggesting it would be beneficial for Joe Biden to be inaugurated and to walk into the White House on 20th January, following the US general election next week. However, I think there'd be nothing worse than Mr B...

Lockdown has absolutely crippled the economy and what for? We have a similar death rate to Sweden which never locked down, the average age of death from COVID in the UK is 82.4 when the average age of death for the UK as a whole is only 81.2. Not only that, what I would like to see published is the death rates from other illnesses such as cancer, h...

Samuel Johnson famously said, 'when a man is tired of London, he is tired of life'. However, unlike S.Johnson, it seems that B.Johnson has succumbed to this, in light of the lack of news surrounding the future of our greatest financial asset, the City of London. Whilst the recent focus has been perpetually on State Aid and fishing rights, the City ...

By Catherine McBride On Friday the BBC headline news included an item entitled: Shoppers could pay more after no-deal Brexit. The story was planted by the British Retail Consortium (BRC) who said that tariffs would add £3.1bn a year to the cost of importing food and drink unless the UK and the EU can strike a free trade agreement. This was a ...

As reported in The Sunday Telegraph last week, and again today, some Treasury officials have been flirting with the idea of tax increases to foot the bill for the COVID measures put in place and for the lockdown that the left and media were so desperately pressuring for. However, according to several media sources, Number 10, Boris Johnson and Domi...

The Defund The BBC campaign launched last month with the aim of decriminalising failure to pay the TV licence fee by the end of 2020 and reducing its remit to cover BBC content only, rather than all Live channels. The campaign has enabled a much-needed debate about the BBC's role in modern Britain and, should it succeed, we can expect to see a much...

Professor Patrick Minford and The Bruges Group are rightly calling to: Cut corporation tax by 10%: £32 billionAbolish the very top additional 5% rate: £1 billionCut the top rate of income tax to 30%: £15 billion.Cut the standard rate of income tax by 5%: £28 billion. The history of tax cuts in the United States demonstrates why these proposals will...

Margaret Thatcher's Bruges Speech to the College of Europe in September 1988 - YouTube https://www.youtube.com/watch?v=rqv8HF84EOs&t=1s The Bruges Group was set up in 1989 in honour of one speech, a now landmark address made by our then Prime Minister Margaret Thatcher to the College of Europe on 20th September 1988 on the 'Future of Europe'. L...

During this pandemic, I felt it would be the perfect opportunity to take a closer look to the careers of some political giants who don't always get the recognition or remembrance they deserve. One of my greatest interests is political history and every Friday I will publish an article outlining the career and some interesting facts about some polit...

During these awful and bleak times, I felt it would be the perfect opportunity to take a closer look to the careers of some political giants who don't always get the recognition or remembrance they deserve. One of my greatest interests is political history and every Friday I shall publish an article outlining the career and some interesting fa...

During these awful and bleak times, I felt it would be the perfect opportunity to take a closer look to the careers of some political giants who don't get the recognition or remembrance they deserve. One of my greatest interests is political history and every Friday I shall publish an article outlining the career and some interesting facts about so...

Institute of International Monetary Research Analysis Professor Tim Congdon CBE is a member of The Bruges Group Academic Advisory Council A lot of interest has been drawn from my recent emails to my fellow macroeconomists and monetary analysts where I pointed out that bank deposits at US commercial banks soared in the fortnight to 2...

During these awful and bleak times, I felt it would be the perfect opportunity to take a closer look to the careers of some political giants who don't get the recognition or remembrance they deserve. One of my greatest interests is political history and every Friday I shall publish an article outlining the career and some interesting facts about so...

Margaret Thatcher's Bruges Speech, 1988 on The Bruges Group YouTube channel https://www.youtube.com/watch?v=rqv8HF84EOs Today marks the death of our greatest peacetime leader, Margaret Thatcher, a woman who defined British politics for more than a generation. Elected as the first female leader of any major political party in the UK in 1975, su...

Last Wednesday, the Chancellor of the Exchequer, Rishi Sunak, celebrated 28 days in Number 11, following Sajid Javid's resignation, by presenting his budget to the House. This budget delivered by the Richmond MP is arguably the most favourable budget since the days of Nigel Lawson standing at the dispatch box outlining his financial forecasts and s...

Boris Johnson and the Conservatives winning a more than impressive 365 seats last December, it gives the PM a working majority, something we haven't seen since the close of the Blair/Brown era.It is fair to say that the next step of Brexit will soon be taken; having left the EU further delays for implementation legislation were not tolerated. But w...

"I wish it need not have happened in my time," said Frodo. "So do I," said Gandalf, "and so do all who live to see such times. But that is not for them to decide. All we have to decide is what to do with the time that is given us." JRR Tolkien. Although the bunting is out for Brexit in the wake of a resounding victory of a Conservative Government, ...

The Bruges Group is opposed to the acceptance by Parliament of the Withdrawal Agreement and Political Declaration which has been released today. The Bruges Group has always put the highest priority in maintaining the integrity of the United Kingdom. This agreement provides for a different status for Northern Ireland and therefore has the potential ...

The following article and above PDF are speeches by Richard Tice MEP for the Brexit Party and also property businessman; Swedish-British billionaire businessman Johan Eliasch who is CEO of sportswear giant Head; Sir John Nott the former Secretary of State for Trade and Industry then Defence under Margaret Thatcher; Peter Lilley the former Sec...

A policy model for a clean Brexit - no queues at Dover, no Irish hard border Membership of the EU Customs Union and the (largely contrived) Irish border issue are once more on the front pages. After success in the Lords, Remainers smell blood and are slavering at the prospect of defeating the Government in forthcoming Commons votes. Given thi...

[pb_row ][pb_column span="span12"][pb_heading el_title="Article Sub Title" tag="h4" text_align="inherit" font="inherit" border_bottom_style="solid" border_bottom_color="#000000" appearing_animation="0" ]Unlocking the benefits of leaving the EU[/pb_heading][pb_heading el_title="Article Sub Title 3" tag="h4" text_align="inherit" font="inherit" border...

[pb_row ][pb_column span="span12"][pb_heading el_title="Article Sub Title" tag="h4" text_align="inherit" font="inherit" border_bottom_style="solid" border_bottom_color="#000000" appearing_animation="0" ]The EU is a dysfunctional organisation in the area of corporate tax[/pb_heading][pb_heading el_title="Date" tag="h5" text_align="inherit" font="inh...

[pb_row ][pb_column span="span12"][pb_heading el_title="Article Sub Title" tag="h4" text_align="inherit" font="inherit" border_bottom_style="solid" border_bottom_color="#000000" appearing_animation="0" ]HMRC has set aside £55 billion to cover the potential cost of payments, including interest, which the European Court of Justice will force upon the...

[pb_row ][pb_column span="span12"][pb_heading el_title="Article Sub Title" tag="h3" text_align="inherit" font="inherit" border_bottom_style="solid" border_bottom_color="#000000" appearing_animation="0" ]Tax simplification for Brexit[/pb_heading][pb_heading el_title="Article Sub Title 4" tag="h3" text_align="inherit" font="inherit" border_bottom_sty...

Contact us

246 Linen Hall, 162-168 Regent Street

London W1B 5TB

Director : Robert Oulds MA, FRSA

Founder Chairman : Lord Harris of High Cross